2023 Yearbook:

Showcasing Africa’s Aviation Highlights

In 2023, the aviation industry experienced a resounding resurgence worldwide, marking a pivotal step towards recovery post-pandemic. Global air traffic surged, with projections from the International Air Transport Association (IATA) and Airport Council International (ACI) indicating a climb beyond 90% of 2019 levels and a potential surpassing of pre-pandemic figures by Q2 of 2024. This revitalization in connectivity has infused airlines with optimism, with estimated net profits for 2023 nearing $9.8 billion. However, this upward trajectory still sees a thin margin of 1.2%, a far cry from the 4.2% observed between 2015 and 2019.

Africa’s aviation landscape witnessed significant progress, notably in East Africa, surpassing pre-pandemic levels by Q2 of 2023. The continent as a whole is projected to reach its pre-pandemic passenger statistics by the year’s end, with expected figures of around 85 million passengers, a remarkable 89% improvement from the 2019 count of 95.6 million passengers according to Africa Airline Association (AFRAA).

Zooming in on the extraordinary milestones of 2023, the African aviation industry witnessed a series of firsts. In May 2023, Cairo International Airport etched its name in the annals of its 78-year history, achieving an unprecedented feat with 612 movements and a remarkable 82,000+ passengers in a single day. In the same breath, Cape Town International Airport bid farewell to 2023 with a crescendo, achieving an unparalleled milestone in its 68-year journey. December witnessed the airport welcoming an unprecedented 317,000 passengers, setting a new record in its storied history. Uganda Airlines secured its position among the globe’s top five youngest airline fleets, while Ethiopian Airlines made history by placing a groundbreaking order.

Below we explore the key highlights of 2023 that illuminated Africa’s aviation landscape. Read along to discover the shining achievements, monumental milestones, and the challenges that left indelible mark on the African skies.

Airspace control

In the realm of airspace control, Somalia accomplished a major feat by regaining control of its airspace after 31 years following the collapse of its state in 1991. Prior to this reclassification to Class A airspace, the control of Somali airspace had been administered from Nairobi, Kenya, and was classified as Class G, denoting uncontrolled airspace.

Despite this, challenges persist in African airspace. Libyan airspace remains closed for over a decade, and recent events in Niger Republic caused by a coup d’état and Sudanese war led to airspace closures, impacting regional and global connectivity.

Launch of new airlines

2023 saw the introduction of several airlines. Eswatini Air soared onto the scene, securing its Aircraft Operator Certificate (AOC) in January and commencing scheduled operations just two months later. Their inaugural flights connected Eswatini to Johannesburg, with subsequent additions to Durban enhancing their network.

The skies also welcomed Egypt’s Sky Vision Airlines, which debuted its operations in January following its AOC approval in 2022. Meanwhile, Nigerian 7Star Airlines, operating as a charter airline, successfully obtained its Air Transport Certificate from the Nigerian Civil Aviation Authority (CAA).

Notably, other airlines gained their AOCs, signifying their readiness to take flight. Nigerian Rano Air Limited and Elysia Airlines from Guinea joined the ranks of approved carriers. Additionally, Cronos Airline Benin embarked on its official operations on May 4th, marking its presence in the industry. Suid Cargo, an all-cargo airline based at Johannesburg’s O.R. Tambo International Airport, took flight through a partnership with Kenya’s Astral Aviation while Burkina Faso Kangala Air Express was founded receiving two ATR72-500 aircrafts by the years’ end from Nordic Aviation Capital.

Amidst these launches, Nigeria Air, the highly anticipated flag carrier of Nigeria, made its debut. However, the initial buzz surrounding its launch quickly dissipated, leaving more questions than answers.

Airline connectivity/routes

A significant improvement in airline routes and connectivity emerged in 2023, with the reinstatement of numerous halted routes, amplifying the resurgence in air travel post COVID-19 pandemic. While many pre-pandemic routes resumed, the spotlight in this article is on the introduction of new or revitalized routes following substantial hiatuses.

Starting with intercontinental connectivity, South Africa Airways (SAA), once an African aviation giant that had scaled down to offering domestic and regional flights, made a triumphant return to intercontinental voyages, launching its first long-haul flight in three years to Sao Paulo in Brazil. Aeroflot marked a grand comeback to Mauritius after a staggering absence of over 30 years, while Egypt Air announced its reemergence on the Los Angeles route after 24 long years.

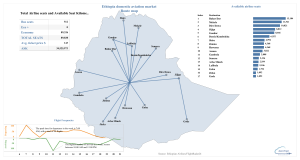

Ethiopian Airlines, true to its pioneering spirit, resumed regular flights to Denmark after a two-decade hiatus, echoing a similar revival with its Karachi services after 19 years and Gatwick flights after 17 years, alongside a resurrection of services to the Central African Republic after an 8-year lull. Meanwhile, Air Algeria reignited its link to China after a 19-year break.

The comeback list didn’t stop there—Lufthansa reignited the Munich-Johannesburg route after 19 years, while ITA Airways revived the Tripoli-Rome flights after a decade. The expansion fever continued, with Air Peace touching down in Tel Aviv in Israel, a first for a Nigerian Carrier and also together with Uganda Airlines opened new doors to Mumbai. Rwandair made its mark in Paris while Fly Dubai celebrated the inauguration of Mogadishu operations and expanded its presence in Egypt by adding Cairo as its second destination.

Closer to home, the pulse of intra-African connectivity quickened. South Africa Airlink and Togo’s ASKY Airlines swooped into the limelight, spearheading the charge for revitalized intra-African travel. Picture this: both airlines took their maiden voyages to Nairobi. But that’s not all. South Africa Airlink stretched its wings further, venturing into Malawi, Zimbabwe, Mozambique, Madagascar, all while ramping up domestic flights and destinations. Meanwhile, Uganda Airlines also spread its wings, kicking off operations to West Africa, starting with Lagos in Nigeria while ASKY Airlines set its sights on Luanda, Angola, and dreamt of crossing continents, pondering Paris and Madrid as their first non-African jaunts.

Yet not all paths saw a gleaming dawn. Some routes faded into sunset, and airlines bid adieu. Air Belgium waved goodbye to South Africa and Mauritius its only African markets, while Qatar Airways packed its bags from the Namibian scene. Air Senegal, once buzzing, paused its rhythm to Milan, Marseille, Barcelona, and Lyon. South Africa Airways took an indefinite hiatus from Malawi, Fly Angola’s domestic skies fell silent, and TAAG Angola and Air France bowed out of the Ghanaian and Gambian scenes respectively, one after a mere three months. It was a time of shifts and farewells, with Kenya 748 Air Services switching gears back to charter services after suspending its domestic passenger schedules.

But amidst the setbacks, some airlines faced turbulent skies. Congo Airways struggled, citing aircraft shortages for suspending commercial operations, while Burkina Faso’s Liz Aviation took a breather, halting regional flights and coping with aircraft withdrawals. Nigerian Azman Air found itself grounded, grappling with aircraft maintenance challenges that led to a halt in its operations.

Airline profitability

In the labyrinth of airline finances, African carriers faced a substantial revenue loss estimated at $3.5 billion, a sharp plunge from their 2019 earnings, according to AFRAA. But a glimmer of hope emerged on the horizon for FY2023, with a promising outlook hinting at reduction in losses to around $1 billion.

Throughout this challenging period, Ethiopian Airlines soared high, maintaining its crown as the continent’s most profitable carrier. It wasn’t alone in the winners’ circle—TAAG Angola Airlines and Air Seychelles soared to profitability, netting USD 800,000 and $8.4 million respectively in 2022/2023 financial year. For Air Seychelles, this marked a phoenix-like resurgence after grappling with financial challenges for five long years. Kenya Airways joined the triumph parade, boasting impressive first-half profits, a much-needed breakthrough after six years of navigating choppy financial waters.

However, amidst these victories, a grim shadow loomed over Africa’s skies: the struggle to repatriate blocked airline ticket sales. A staggering truth emerged—African nations held a hefty 70% share of the world’s blocked airline ticket funds, totaling over $1.68 billion from a global pot of $2.36 billion. Nigeria held a hefty 34% stake in this tangled web of blocked funds, painting a hazy picture for airline connectivity. This issue cast a pall over initiatives like the Single African Air Transport Market (SAATM) and clipped the wings of aspirations for fully realized open skies across the continent.

ACMI and fleet renewals

2023 emerged as a hallmark year, painting the continent with a canvas of record-breaking aircraft orders. Ethiopian Airlines, seizing the spotlight at the Dubai Airshow, etched history with an audacious deal to secure 84 aircraft. This monumental acquisition included a fleet upgrade boasting 11 B787 Dreamliners and firm orders for 20 B737 MAX, with tantalizing options for 15 and 21 more of these Boeing models. Not stopping there, Ethiopian Airlines also locked in commitments for 11 additional A350-900 aircraft while holding the keys to purchase six more. The year also witnessed a grand arrival of several new aircraft into their fold—think B787s, the tenth B777 freighter, and the twentieth A350-900, flaunting a remarkable 30% Sustainable Aviation Fuel (SAF) capability, cementing Ethiopian Airlines’ reign over the African skies.

Meanwhile, EgyptAir showcased its prowess at the same aviation extravaganza, sealing a significant deal with Airbus for 10 A350-900 aircraft. Moreover, the airline secured another feather in its cap by striking a deal with Air Lease Corporation for up to 18 B737-800s. EgyptAir’s fleet in 2023 also flourished with the introduction of six new A321neo aircraft, marking their debut as the first African operator of this coveted model, adding to their kitty from various lease agreements. Air Algerie joined this aviation crescendo with a robust purchase agreement, ordering 8 B737 MAX9, 5 A330-900, and 2 A350-1000 aircraft.

This period saw airlines across the continent renew their fleet. Airlink bolstered its strength with at least nine additional Embraer E-190 aircraft, inked through an array of diverse lease agreements. ASKY Airlines celebrated a significant milestone with the debut of two B737-MAX aircraft, a new addition to their fleet. Berniq Airways from Libya expanded its reach, acquiring six A320s, while rival Buraq Airways soared with its inaugural A320.

Other standout performers included Air Mauritius, ordering three A350-900s through lease agreements while amping up their fleet with additional A330s. Air Tanzania’s jubilant embrace of its first cargo plane, a B767-300F, and marked their distinction as the pioneer African recipient of the B737-MAX9. TAAG Angola heralded the arrival of its inaugural cargo carrier, a B737 BCF, as Kenya Airways welcomed its very first B737-800 cargo aircraft. JamboJet expanded its fleet’s horizons with the arrival of its eighth Dash 8-Q400.

These fleet expansions weren’t solitary stars; they signaled a symphony of growth within the vibrant African aviation landscape.

Infrastructure and financing

Africa aviation industry in 2023 also boasted remarkable strides in aviation infrastructure. Angola spearheaded this with the grand unveiling of Dr. Antonio Agostinho Neto International Airport, a $3 billion marvel ready to host 15 million travelers yearly, and set to dethrone Quatro de Fevereiro Airport as Angola’s primary air gateway for both passengers and cargo.

Chad introduced the Chad-Am-Djarass International Airport, boosting the nation’s aviation infrastructure in its northeastern region. Meanwhile, Zanzibar, Tanzania, flaunted a gleaming $129 million terminal, enriching its aviation hub, while Zimbabwe’s Robert Gabriel Mugabe International Airport followed suit with a new $153 million terminal. Ghana’s Tamale Airport debuted a new terminal, enriching passenger experience at the facility. Algeria’s Algiers International Airport inaugurated a second runway, elevating its annual passenger capacity to a staggering 18 million. Zambia rejoiced as Kasama Airport reopened after a rigorous nine-year renovation project, marking a significant milestone.

Even amidst a major fire incident at Lagos Murtala Muhammed International Airport, Nigeria showcased resilience, inaugurating an agro cargo airport, refurbishing its main runway, and setting the wheels in motion for a cargo village. The Muhammadu Buhari Cargo Airport in Damaturu, Yobe State, took flight, while the Wachakal airstrip edged closer to completion.

In terms of financing initiatives, Kenya committed $8 million for constructing the ICAO regional headquarters, while Tanzania secured a substantial $428 million loan from the UK to open up the island of Pemba and modernize its airports. Chad secured $32 million from France to revamp Njamena airport, with the government allocating another $1.2 million earmarked for Abeche airport’s upgrade. Mozambique soared with a $22.5 million grant from Japan to equip six airports.

Nigeria’s dedication shone through with a $20.9 million allocation for Enugu airport’s control tower and runway refurbishment, coupled with a pioneering venture—a $5 million investment in establishing a two-seater aircraft assembly plant. Furthering this commitment, a significant $51 million expansion project kicked off at Katsina airport, underscoring the united efforts across African nations to fortify aviation infrastructure and propel growth within the aviation sector.

Sustainability

In the quest for greener skies, 2023 was a year of monumental flights breaking barriers and setting new standards in aviation. Kenya Airways and Royal Air Maroc took center stage in this eco-friendly revolution, pioneering historic journeys using sustainable aviation fuel (SAF). Kenya Airways soared into uncharted territories, spearheading the Sustainable Flight Challenge (TSFC) by launching the first Africa intercontinental SAF-powered flight from Nairobi to Amsterdam. Meanwhile, Royal Air Maroc carved its own path, achieving a milestone with the first intra-Africa SAF-powered flight between Casablanca and Dakar Blaise Diagne International Airport in Senegal. Notably, both airlines utilized the Boeing 787 Dreamliner for these groundbreaking journeys. These two important events significantly contributed to the global effort to curb aviation-related environmental pollution.

Conclusion

As we gaze into the horizon, the forecast for airlines in 2024 is promising, hinting at a potentially profitable trajectory. The resilience and strategic maneuvers exhibited by these airlines amid adversity signal a positive turn in their financial performance, paving the way for a more prosperous phase and sustainable future in the aviation industry in Africa and across the globe in the coming years.