The Single Africa Air Transport Market (SAATM) stands as a pioneering initiative under the African Union‘s Agenda 2063, aimed at forging a unified air transport market across the continent. This visionary move promises substantial freedoms for air transport, particularly for passenger and cargo operations from the first through the fifth freedom, all while preserving cabotage rights.

However, SAATM has encountered significant challenges and criticism from certain African governments and airlines. They argue that the agreement could result in a scenario where a few major airlines dominate the market, potentially stifling competition. Despite these concerns, development organizations and independent analysts foresee a multitude of benefits. These include the potential for reduced airfares, increased air travel accessibility for the masses, and a positive economic ripple effect across African economies.

SAATM, born in 2015 and officially unveiled during the 30th African Union Summit in Addis Ababa on 28 January 2018, represents a monumental step towards realizing the ambitions set forth in the 1999 Yammoussoukro Decision (YD). This decision builds upon the foundational Yamoussoukro Declaration of 1988, emphasizing the need for a unified African air transport market.

At its core, SAATM entrusts the African Civil Aviation Commission AFCAC, a specialized agency of the African Union, as its implementing arm. Working hand in hand with the Regional Economic Communities (RECs), SAATM aims to encourage member states to progressively liberalize both scheduled and non-scheduled intra-Africa air transport services. This collaborative effort marks a significant stride towards enhancing connectivity and fostering economic growth across the African continent.

As a crucial step in promoting SAATM, AFCAC, in collaboration with African Airlines Association (AFRAA), organized a capacity-building workshop focused on the Yammoussoukro Declaration/Decision Regulatory Text for airlines. Held at the East Africa School of Aviation (EASA) in Nairobi from 18-20 March 2024, this event was jointly organized with the Africa Union Commission (AUC). A representative from AeroTrail was privileged to be among the participants of this enlightening workshop, where valuable insights were shared and key information was gleaned.

The three-day workshop was structured around four insightful sessions that delved into various aspects of the Yammoussoukro Declaration (YD) and its regulatory framework as follows:

Session 1: Exploring Annex 4, which covers the powers, functions, and operations of the Executive Agency, along with a deep dive into Annex 5 on Competition Regulations. This session featured insightful sharing of experiences and best practices by the COMESA Competition Authority.

Session 2: Unpacking Annex 6, focused on Consumer Protection Regulations, including valuable exchanges of experiences and best practices led by the Kenya Consumer Protection Association. Additionally, this session included a presentation on the revised African Civil Aviation Policy (AFCAP).

Session 3: Addressing Annex 3 and the operationalization of the YD/SAATM Dispute Settlement Mechanism. Discussions centered on the Monitoring Body of the YD/SAATM, Key Performance Indicator (KPI) audits for YD compliance, and the Joint Prioritized Action Plan (JPAP).

Session 4: Perspectives from Partners on the Implementation of SAATM. This session provided a platform for airlines to share their insights on the YD legal framework, strategies for expediting SAATM implementation, challenges, and opportunities. Furthermore, it explored the progress and implications of the African Continental Free Trade Area (AfCFTA) Secretariat on the successful implementation of SAATM.

Each session offered a unique perspective and contributed to a comprehensive understanding of SAATM’s regulatory landscape and its impact on the African aviation sector.

The scenario.

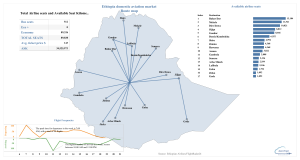

The efforts spearheaded by AFCAC have undeniably made significant strides in advocating for the benefits of opening up Africa’s airspace to member states. However, despite having a solid policy framework in place, challenges persist during the implementation phase. One glaring issue is the limited number of non-stop flights connecting African countries. Out of the 54 sovereign nations in Africa, only seven have direct flights to one third of these countries. This disparity results in longer travel times within the continent compared to other regions globally.

To illustrate this point, consider the journey from Banjul, The Gambia’s capital, to Nairobi, Kenya. This route typically involves at least three layovers and nearly a full day of travel, assuming everything goes smoothly. Not only does this inconvenience passengers, but it also comes with a hefty price tag due to the multiple operators involved in the journey.

In 2023, African airlines transported approximately 85 million passengers according to African Airlines Association (AFRAA) across a continent with a population of about 1.4 billion. This figure stands in stark contrast to Europe’s annual passenger numbers, exceeding 2 billion according to Airport Council International’s 2023 Statistics, despite Europe having a combined population of 740 million.

To put this into perspective, it means that on average, each individual in Europe takes a minimum of 2 flights per year, while in Africa, it’s closer to one flight per person in 16 years. This glaring disparity paints a concerning picture, especially considering the lack of viable alternative modes of transportation in many parts of Africa.

The Major challenges: From an Airline perspective.

The disparity in air travel numbers between Africa and other regions like Europe may seem puzzling at first glance. While many attributes this to factors like underdeveloped airport infrastructure or ticket affordability, Somas Appavou, the IATA regional director for Africa for external affairs and sustainability, sheds light on a deeper issue during the workshop. He emphasizes that the traditional “win-win” approach used in negotiating bilateral air service agreements (BASAs) doesn’t necessarily apply in Africa due to the vast differences in economic development among states. This means that some countries may gain advantages in certain areas of the agreement, like trade, but could lose out in terms of aviation rights, capacity clauses, or designations. In essence, Somav highlights the complex dynamics at play in Africa’s aviation landscape, where finding a balanced solution that benefits all parties involved remains a challenging task.

International Air Transport Association (IATA) has identified the major hurdle for airlines operating in Africa: cost. Their analysis reveals that fuel expenses for African airlines make up a staggering 40% of their total costs, significantly higher than the global average of 25%. What’s more, the continent faces a challenge of limited supplier options, often with only one supplier dictating prices, creating an imbalance in the market. This issue extends beyond fuel to other crucial areas like spare parts suppliers, exacerbating the challenges faced by airlines in Africa.

Below, we highlight some of the challenges faced by Africa airlines, as outlined during the workshop.

1, Harmonization of legal framework regulation

The workshop highlighted a critical call for Africa to unlock its aviation potential by initiating deregulation. Currently, regulations are fragmented across the continental, regional economic communities (RECs), and national levels, leading to a maze of conflicting and overlapping rules. Airlines are advocating for harmonization, envisioning a scenario where a maintenance engineer, pilot, or technical officer certified in Nigeria can seamlessly operate in South Africa or any other country within the continent without the need for extensive conversion and notarization processes for their licenses.

2. Exchange rates (Multiple currencies)

The complexity of Africa’s currency landscape is staggering, with 42 separate currencies and varying exchange rates. This multitude of currencies poses significant challenges for payments between countries, hindering the seamless flow of transactions essential for boosting intra-Africa air travel and tourism. Imagine the frustration of a traveler navigating through multiple countries, constantly losing out on exchange rates and limiting their travel itinerary due to currency complications.

Furthermore, some African countries insist on paying airlines in their own currencies, causing airlines to bear the brunt of fluctuating exchange rates and weakening currencies. This practice not only impacts airline revenues but also leads to blocked funds, further hampering connectivity and operational efficiency.

Addressing these currency complexities is vital for fostering a more interconnected and thriving aviation sector in Africa. Streamlining payment systems and adopting common currency practices could unlock immense potential for growth and enhance the travel experience for both tourists and airlines alike.

3. Mostly state-owned operators

When delving into the ownership structures and business models of Africa’s airlines, it’s striking to note that over 60% of them are government-owned. This ownership dynamic often leads to tendencies of state protectionism, hindering the development of necessary economic and commercial strategies vital for market success and profitability. These government-owned carriers frequently exploit the limitations of Bilateral Air Service Agreements (BASAs), using them to curtail traffic rights for other airlines. This scenario creates a challenging environment for private carriers, as they face obstacles to operate efficiently and compete on an equal footing.

4. Priorities

The practical challenges of implementing liberalization agreements add to the hesitancy of states to fully commit to these initiatives. Coordinating regulatory frameworks, ensuring fair competition, and addressing infrastructure constraints require significant time, resources, and cooperation among multiple stakeholders. Some states may be cautious about embarking on such complex processes, particularly when they perceive potential risks to their national interests or industries. As a result, despite signing agreements and expressing intent, many states struggle to translate these commitments into concrete actions towards liberalizing their airspace.

5. The technical Know-how (Skill)

The technical skill gap within Africa’s aviation sector is a pressing issue, showcasing stark differences in expertise across various states. Remarkably, South Africa leads the continent by providing over 80% of pilot training. Yet, the absence of dedicated aviation training institutions in many countries presents a major hurdle. This lack not only complicates skill-sharing efforts but also fuels brain drain as skilled professionals are lured away by developed nations. Compounding this issue is the underrepresentation of youth, who make up a substantial portion of the population, in policy-making processes related to aviation and technical training.

6. Economic development philosophy (Leberal versus conservative)

In Africa’s airspace landscape, there’s a tug-of-war between two economic development ideologies: liberalism and conservatism. The liberal school champions airspace liberalization akin to a free-market strategy, focusing on competition, airline autonomy, minimal regulation, and enticing foreign investments. Conversely, conservatism advocates for stability, gradual changes, government supervision, sound fiscal strategies, and fostering a conducive business climate. Striking a balance between these contrasting philosophies is crucial for unleashing the full potential of the aviation sector, fostering safety, and driving sustainable economic progress.

7. Capability to assess impact of liberalization

Assessing the social-economic impacts of airspace liberalization in Africa faces considerable challenges due to the reluctance of states to share data, hindering accurate evaluations of the effects on employment, economic growth, and consumer welfare. The diverse nature of African economies and regulatory environments further complicates this assessment, as each country presents unique challenges ranging from infrastructure limitations to political considerations. Collaborative efforts involving regional organizations, industry stakeholders, and academia are crucial to bridge the data gap, improve transparency, develop standardized data collection methods, and establish frameworks for comprehensive impact assessments. By addressing these challenges, Africa can better understand and leverage the potential socio-economic benefits of airspace liberalization for sustainable aviation growth and development.

8. Reciprocity

Many Bilateral Air Services Agreements (BASAs) in Africa operate on the principle of reciprocity, which poses challenges due to unequal connectivity levels among states. For instance, when one country has a national carrier operating wide-body aircraft and another operates regional aircraft, achieving a fair 50:50 capacity allocation becomes impractical. Even if more flight frequencies are allocated to the smaller operator, market dynamics, such as passenger preferences for a particular airline, can influence the outcome. Additionally, countries with multiple international airports, like Kenya and Uganda, face dilemmas regarding access rights. Should Kenya limit Uganda carriers to its primary airport, given that Uganda has only Entebbe International Airport, or should it allow access to other airports to promote equitable connectivity? These complexities highlight the need for more nuanced approaches in BASAs to ensure fair and effective air transport operations across Africa.

9. Irreversibility of agreements.

Some African states exhibit reluctance to amend their earlier Bilateral Air Services Agreements (BASAs) to accommodate the evolving aviation landscape, even though some of these agreements were crafted many years ago. They maintain the status quo until they achieve operational parity with their partner countries, signaling a resistance to adapt to the changing dynamics of the aviation industry. This rigidity can impede progress and innovation in air transport, highlighting the need for more flexible and adaptive agreements that reflect the current realities of the aviation market.

Conclusion.

Despite the considerable challenges elaborated above and those posed by high airline operational costs, Africa’s air traffic patterns are on a steady upward trajectory, with projections indicating a surge to over 300 million passengers annually by 2040. This growth trend underscores the resilience of the African aviation market. However, unlocking the full potential of this growth hinges on addressing key cost factors that burden airlines, including fuel expenses, airport charges, regulatory fees and taxes, maintenance costs, insurance premiums, and financing constraints. Achieving a reduction in these operational costs, coupled with creating a conducive environment through deregulation and fair competition policies, is crucial for fostering rapid expansion and sustainable development in the African aviation sector.

In 2018, African Union (AU) leaders embraced two pivotal agreements: the African Continental Free Trade Area (AfCFTA) agreement and the Protocol to the Treaty Establishing the African Economic Community Relating to Free Movement of Persons, Right of Residence and Right of Establishment (Free Movement Protocol). These agreements were reinforced by progressive continental policies like the Migration Policy Framework for Africa, the Single African Air Transport Market (SAATM), and the AU Strategy for a Better Integrated Border Governance. The ambitious vision was for visa-free movement among member countries by 2023, aligning with SAATM’s goals. However, as 2023 has passed without this realization, questions arise: Are African governments ready to demonstrate unified political commitment for airspace liberalization, or are we destined to repeat the holding pattern of the past 35 years?

About Us.

AeroTrail is a leading consultancy offering cutting-edge expertise in market research, advanced data analytics, and strategic modeling solutions tailored specifically for the aviation and logistics industries. Our commitment lies in gathering, analyzing, modeling, simulating, and delivering data-driven insights crucial for the development and success of the domestic, regional, and continental aviation and logistics markets. Get in touch with us Here.