Airline connectivity:

Insights from East Africa Community (EAC) countries main aviation hubs

This is a detailed analysis of the scheduled passenger airline operations of the main airports in the seven East African Community (EAC) member countries.

Prelude

The East Africa Community (EAC) constitutes one of the eight regional economic communities (RECs) closely aligned with the African Union. Its principal objective is to facilitate regional economic integration among its member states while contributing to the broader African economic community (AEC). This regional endeavour was established in accordance with the Abuja Treaty of 1991.

The EAC consists of seven sovereign member nations, namely Burundi, the Democratic Republic of the Congo, Kenya, Rwanda, South Sudan, Tanzania, and Uganda. Its central administrative hub is situated in Arusha, Tanzania. The cornerstone of this collective endeavour is the treaty that formally ushered it into existence. This pivotal agreement was signed on November 30, 1999, and subsequently attained full legal status on July 7, 2000, following its ratification by the original three partner states: Kenya, Tanzania, and Uganda.

The collective population of these nations, as per the latest estimates from the United Nations for the year 2023, stands at a significant figure of 313,684,105 individuals. This diverse populace is distributed across a vast geographical expanse, spanning a total of 4,812,126 km2. It is noteworthy to mention that the Democratic Republic of the Congo (DRC) emerges as the largest country within the region, both in terms of geographic size and population.

To offer a meaningful comparison, it is worth noting that the EAC region harbors a population roughly equivalent to approximately 70% of the entire European Union (EU) population, despite occupying approximately 86% of the EU’s geographical area. Furthermore, it encompasses approximately 92% of the total population of the United States, while covering roughly 59.9% of the contiguous geographical expanse of the United States.

Economically, the EAC region collaboratively generates a Gross Domestic Product (GDP) totaling 326.43 billion, underscoring its increasing economic prominence.

From a cultural perspective, the EAC region distinguishes itself through an even greater array of cultural groups compared to both the United States and the European Union. This vast cultural diversity enhances the richness and intricacy of its cultural fabric. Swahili stands as the prevailing language, with English and French holding the status of official languages alongside Swahili within the region.

EAC countries air travel insights

The East African Community (EAC) enjoys global connectivity through an extensive network of international airports, the majority of which are strategically located in or proximate to the region’s major urban centers. In total, the region boasts a network of over 500 airports and airstrips, each with varying degrees of airline operations.

Citizens of East African member states are afforded the privilege of unrestricted travel within the region by presenting a valid national passport. Furthermore, the East African Passport, introduced as a travel document with a six-month validity, was specifically designed to streamline border crossings for East Africans. It is crucial to underscore that this passport is exclusively designated for travel within the confines of the East African Community (EAC) region.

In most instances, the necessity for a visa is waived for travel within the East African Community (EAC), with the exception of journeys to or from the Democratic Republic of Congo (DRC). Nevertheless, it remains imperative to carry a passport when traversing borders within the EAC. It is worth highlighting that Kenya, Uganda, and Rwanda have taken a significant stride by acknowledging their respective citizens’ national identification cards as valid travel documents. This recognition stems from a binding East African Agreement among these three nations and has yielded considerable implications for air travel within this specific bloc of countries.

In the following sections, we shall explore the ramifications and outcomes of this agreement. This article is particularly focused on the principal airports of each member state, as enumerated below, to glean valuable insights pertaining to scheduled passenger airline operations.

1. Burundi: Bujumbura International Airport

2. Democratic Republic of the Congo: N’djili International Airport

3. Kenya: Jomo Kenyatta International Airport

4. Rwanda: Kigali International Airport

5. South Sudan: Juba International Airport

6. Tanzania: Julius Nyerere International Airport

7. Uganda: Entebbe International Airport

Through a meticulous examination of the activities and intricacies inherent in these pivotal airports, our objective is to furnish a comprehensive understanding of the scheduled passenger airline operations within the East African Community (EAC).

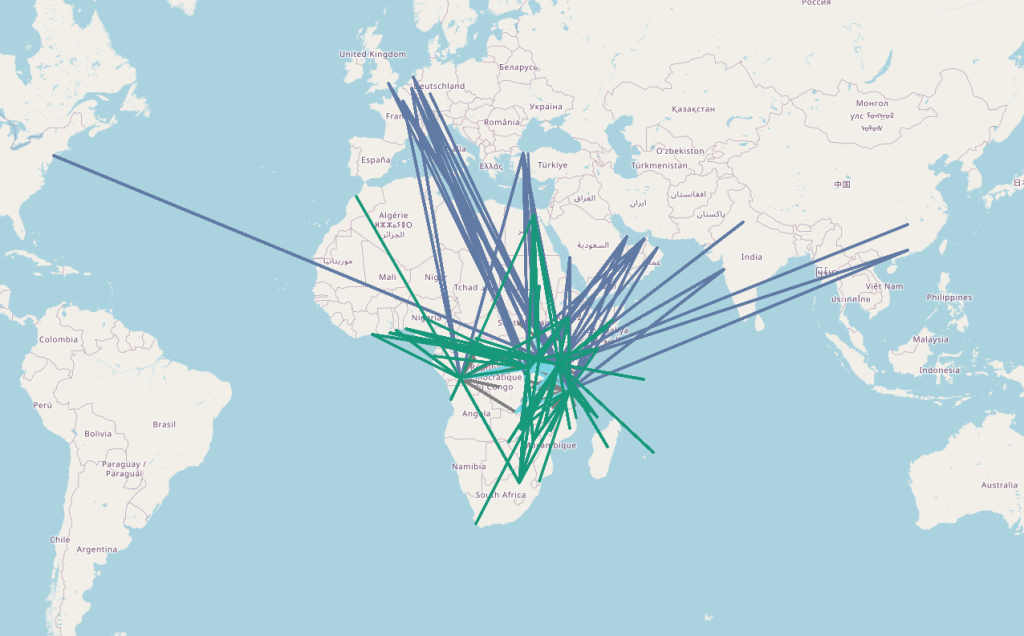

Map 1. Scheduled routes to/from the main airports in the EAC

The overall air connectivity picture

Kenya’s Jomo Kenyatta International Airport and Uganda’s Entebbe International Airport hold the distinction of being the exclusive airports that facilitate scheduled airline connections to the main airports of all other East African Community (EAC) member nations. Within the domain of regional networks, it is noteworthy that Entebbe Airport leads the pack with flights servicing approximately fifteen regional destinations. Following closely are Jomo Kenyatta International Airport and Kigali International Airport, both offering scheduled connections to ten regional destinations each.

Figure 1. Regional destinations per airport hub

Upon conducting a more in-depth analysis of the overall aviation activities at these airports, with the exclusion of freight and general aviation, we can extract valuable insights. According to passenger operation statistics, there are approximately 486,732 airline seats available on a weekly basis, enabling the transportation of roughly 70,000 passengers daily. However, when juxtaposed against the backdrop of major international airports globally, such as London’s Heathrow Airport, which reportedly accommodates over 200,000 passengers daily, as documented by Simple Flying, it becomes evident that these airports operate on a notably smaller scale.

Kenya’s principal aviation hub, Jomo Kenyatta International Airport, emerges as the East African Community’s most extensively connected airport. It plays a pivotal role, accounting for approximately 44.4% of the total passengers processed. This airport services around 27 airlines that offer direct (point-to-point) flights, extending connectivity to roughly 54 destinations both within Africa and beyond.

Figure 2. Distribution of airline seats available within the EAC

Julius Nyerere International Airport in Tanzania also enjoys robust connectivity, boasting affiliations with approximately 27 airlines and facilitating 41 direct airline connections. It contributes to the transportation of 19.8% of the total airline seats available within the EAC. In contrast, Bujumbura International Airport in Burundi is noted for having the lowest share of airline seats among the member states, contributing approximately 1.73% of the total airline seats. It is essential to acknowledge that a country’s geographical size and population can exert a significant influence on its level of connectivity.

In terms of weekly available seat kilometers (ASK), the collective contribution of the seven airports amounts to approximately 1.25 billion ASK. When juxtaposed with the total airline seats, this facilitates the computation of revenue passenger kilometers (RPK) at an estimated 70% of the load factor (L.F), resulting in an approximate figure of around 874 million RPK. Consequently, the approximate airline revenues generated from these operations are estimated at 206 million USD.

Shifting our focus to intercontinental routes, the lengthiest route within the network is the Nairobi–New York route, spanning 11,832 kilometers. This route is serviced daily by Kenya Airways, utilizing B788 aircraft. Following closely in terms of distance is the Nairobi-Changsha route at 8,752 kilometers, Dar-es-Salaam–Guangzhou at 8,692 kilometers, Nairobi-Guangzhou at 8,686 kilometers, with Dar-es-Salaam-Amsterdam at 7,324 kilometers, comprising the top five longest routes in the network.

Figure 3. Top 5 longest routes per area of operation

Within the context of intra-Africa routes outside of the East African Community (EAC) countries, the Casablanca to/from Kinshasa route emerges as the most extensive point-to-point airline route, encompassing a substantial distance of 4,819 kilometers. This route is efficiently operated by Royal Air Maroc. Following closely in terms of distance is the Nairobi – Abidjan route at 4,598 kilometers. On a regional scale, the Nairobi-Kinshasa route spans 2,425 kilometers, constituting the longest route within the region, with the Entebbe – Kinshasa route covering a distance of 1,969 kilometers.

Conversely, concerning domestic airline routes, the Democratic Republic of the Congo (DRC) offers the most extensive domestic routes when compared to other East African Community (EAC) countries. Noteworthy examples include the Kinshasa-Goma route at 1,574 kilometers, Kinshasa-Lubumbashi at 1,567 kilometers, Kinshasa-Kisangani at 1,235 kilometers, and Kinshasa-Kindu at 1,188 kilometers. Furthermore, the route connecting Dar-es-Salaam to Kigoma is identified as the longest domestic route among the EAC countries, spanning a distance of 1,085 kilometers, excluding routes within the DRC.

It is particularly noteworthy that these five routes represent the sole domestic routes within the EAC region that exceed a distance of 1,000 kilometers.

Overall passenger seats statistics

In terms of weekly airline seat capacity originating from the seven regional airports, the paramount destination in terms of both arrivals and departures is Addis Ababa, with approximately over 45,000 airline seats. This destination firmly maintains its position as the preeminent passenger hub, largely attributable to Addis Ababa’s status as a major connecting city. Dubai in the United Arab Emirates closely follows, with an allocation of approximately 35,000 seats. Nairobi secures the third position with an estimated 27,000 seats, while Mombasa (25,825) and Zanzibar (23,729) complete the roster of the top five destinations in terms of weekly seat capacity.

When we scrutinize these seat allocations according to flight operations, the prominent intercontinental destinations comprise Dubai, as previously mentioned, succeeded by Doha (21,419 seats), Amsterdam (19,734), and Istanbul (16,628). Among intra-Africa destinations, Johannesburg emerges as the primary choice, aside from Addis Ababa, with an approximate availability of 16,852 airline seats, followed by Cairo (6,682), Mogadishu (6,174), and Lusaka (4,762). Within the East African Community (EAC), Nairobi distinguishes itself as the dominant destination by a substantial margin, offering approximately 26,696 weekly airline seats. It is pursued by Entebbe (16,204), Kigali (10,886), Dar-es-Salaam (8,261), and Zanzibar (6,140) in terms of seat availability. This pattern is indicative of the profound impact of the free movement of people initiative implemented by Kenya, Uganda, and Rwanda within the EAC, which significantly enhances the interconnectedness and accessibility of these three nations.

Figure 4. Total available seats per origin/destination

On the domestic level, Kisumu (9,157), Lubumbashi (6,769), and Kilimanjaro (6,036) are other major destinations besides the already mentions cities of Mombasa and Zanzibar.

Airlines seats statistics

When considering the comprehensive weekly airline passenger seat statistics for the region, Kenya Airways ascends to the forefront by a significant margin, boasting a substantial 122,906 seats. Following, Ethiopian Airlines claims the second position with 46,221 seats. RwandAir secures the third spot with an allocation of 36,626 seats, while Air Tanzania occupies the fourth position with 30,964 seats. Notably, the Kenyan low-cost carrier, Jambojet, commands the fifth position with 28,860 weekly seats.

Among non-African airlines, Emirates establishes a strong presence, holding the sixth position with an impressive count of approximately 20,104 weekly seats. In close pursuit is Qatar Airways, securing the seventh position with 19,605 seats. Turkish Airlines secures the ninth position (with Uganda Airline in the eighth spot), providing 16,917 seats, while KLM, the world’s oldest airline, concludes the top ten with an approximate weekly seat offering of 16,458.

Figure 5. Total available seats per airline

Available ASK

In the realm of available seat kilometers (ASK), Amsterdam takes the commanding position with an impressive tally of approximately 132 million ASK, closely trailed by Dubai (130 million), Paris (100 million), Istanbul (81 million), and London (80 million). The airlines that operate these routes also emerge as leaders in terms of ASK, with Kenya Airways firmly establishing itself as the dominant carrier in the region, boasting a remarkable total of about 300 million ASK. It is followed, albeit at a considerable distance, by KLM with 110 million ASK, Turkish Airlines with 81 million ASK, Brussels Airlines with 79 million ASK, and RwandAir with 77 million available seat kilometers.

Ticket pricing and approximate airline revenues

Upon scrutinizing the data, it becomes apparent that the costliest airline routes, when evaluated on the basis of fare paid per kilometer traveled, are typically regional networks serviced by smaller aircraft (ranging from 6 to 18 seaters), as well as routes leading to sought-after tourist destinations such as game parks. For instance, flights offered by Auric Air connecting Kigali and Entebbe to the Grumeti Game Reserve in Tanzania frequently command higher fares per kilometer. Similarly, domestic flights heading to popular tourist destinations often exhibit a higher cost per kilometer compared to other domestic routes spanning equivalent distances.

When we delve into the regular passenger airline schedules, particularly within the context of regional airline networks, routes such as Kigali to or from Bujumbura, operated by RwandAir, stand out with an average cost of approximately two dollars per kilometer for a one-way flight. This appears relatively expensive, especially considering that the distance between these two cities is approximately only 175 kilometers. The most expensive intra-Africa direct airline route to or from the East African Community (EAC) region is the Kinshasa to Luanda route, which averages about one dollar per kilometer, despite being the shortest among intra-Africa routes.

Interestingly, intercontinental airline routes tend to be more cost-effective in comparison to other categories of airline flight operations (such as intra-Africa, regional, and domestic). For instance, the data reveals that the priciest intercontinental route is from Juba in South Sudan to Dubai in the United Arab Emirates (UAE), with a cost of approximately $0.252 per kilometer. This represents a relatively lower expense when juxtaposed with the most expensive regional or intra-Africa routes, which can demand significantly more per kilometer, reaching up to $3.17. Another route that carries a relatively higher cost is the one connecting Nairobi to/from Jeddah, with a price of $0.236 per kilometer.

Figure 6. Top expensive routes ($/km) per area of operation

When we juxtapose the pricing of these routes against the available airline seats and the type of aircraft deployed, a discernible pattern becomes evident: the greater the number of seats available or the deployment of larger aircraft models (such as wide-body planes), the more economical the fares tend to be per kilometer traveled. This observation aligns with the principle of economies of scale, wherein larger aircraft, equipped with more seats, can distribute operational costs across a broader passenger base. Consequently, this leads to reduced ticket prices per kilometer.

Another illustration of how longer airline routes frequently result in more cost-effective airline fares concerning distance can be found in the extended domestic networks of Tanzania. Routes such as Dar-es-Salaam to Mwanza, Kigoma, and Mpanda exemplify this trend. Similarly, within the Democratic Republic of the Congo, domestic routes like those from Kinshasa to Goma and Lubumbashi substantiate this notion, underscoring the cost-efficiency associated with longer domestic air travel.

Conclusion

Upon comparing airports that serve major destinations, such as Dubai, based on their airline seat capacity, an intriguing observation surfaces: the Nairobi-Dubai route, for instance, offers some of the most competitive fare prices per kilometer when contrasted with other airports servicing the same destination city. This phenomenon can be attributed to various factors, foremost among them being the heightened demand and fierce competition along this route. Consequently, this competition leads to greater stability in passenger numbers for the airlines operating on this corridor. In contrast, routes with only a single airline in operation tend to exhibit higher fare costs. For instance, the top nine priciest intercontinental routes lack competition, and this trend extends to regional and domestic flights as well.

A salient example that underscores the influence of competition is found in Kenya Airways’ dominance within the Intra-Africa network. Valuable insights can be gleaned from the Kinshasa-Johannesburg route, which is served by three airlines: South African Airways, Asky Airlines, and Air Cote d’Ivoire. Asky Airlines and Air Cote d’Ivoire operate under fifth freedom rights, and the intense competition engendered by these three airlines renders this intra-Africa route comparatively more economical, with ticket prices averaging around $0.109 per kilometer.

While this observation offers a glimpse into how airspace liberalization and the granting of fifth freedom rights can stimulate competition and drive down air travel costs, it’s imperative to underscore that a comprehensive study is warranted. Such an investigation would aim to delve deeper into the implications of airspace deregulation, as advocated by organizations like the Africa Civil Aviation Commission (AFCAC), particularly through initiatives like the Single Africa Air Transport Market (SAATM). This broader examination would elucidate how these measures can serve as catalysts for enhancing the affordability of intra-Africa air travel.

In conclusion, with regards to the agreement on the free movement of people, notably the recognition of national IDs as valid travel documents among Kenya, Uganda, and Rwanda, it’s noteworthy that the capitals of these three nations emerge as the primary regional routes in terms of available weekly airline seats. This observation leads to the inference that the adoption of the African Union (AU) African Passport and the facilitation of unrestricted movement of individuals across the continent are poised to exert a significant influence on intra-Africa air travel.