With a population of approximately 126 million people, Ethiopia boasts a bustling air transport market set for dynamic growth. Before the COVID-19 pandemic, the International Air Transport Association (IATA) predicted an astonishing 226% expansion in the sector over the next two decades. This high-growth market has been experiencing a staggering average demand increase of 20% annually, highlighting the nation’s promising aviation landscape.

In 2019, the International Air Transport Association (IATA) assessed Ethiopia’s aviation market, revealing its significant socioeconomic impact. Directly employing 19,000 individuals, the sector serves as a vital source of livelihood. But that’s just the beginning—indirectly, it supports approximately 179,000 jobs. Moreover, when factoring in the spending of arriving foreign tourists, the industry’s ripple effect extends dramatically, bolstering an additional 815,000 jobs across various sectors of the economy.

Intriguingly, the aviation industry makes a substantial contribution to Ethiopia’s economic landscape. With a direct input estimated at a whopping US $1.54 billion, it constitutes about 5.7% of the country’s total gross domestic product (GDP).

Presently, Ethiopia boasts a vibrant aviation landscape with 12 airlines offering scheduled passenger operations to and from the country. Among them, Ethiopian Airlines emerges as the undisputed leader, commanding a significant market share.

When examining passenger flows to, from, or through Ethiopia, it’s evident that Africa reigns supreme, constituting over 60% of the total market share. Among these, direct flights to and from Kenya emerge as the busiest route.

Domestic Market Synopsis.

While Ethiopia and its flag carrier have garnered significant attention on the global stage, let’s not overlook the captivating landscape of the domestic aviation market within Ethiopia.

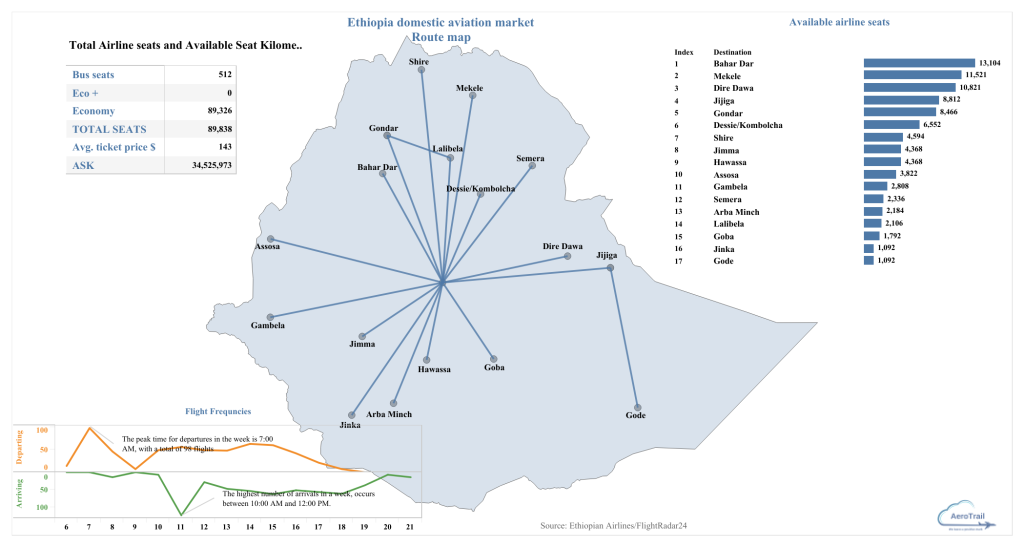

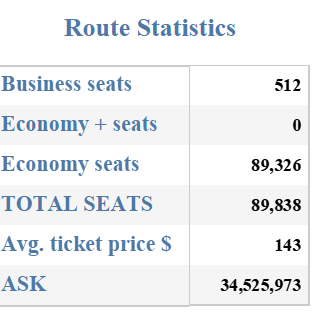

Table 1: Domestic airline Statistics

The Ethiopian domestic air transport market operates within a closely guarded framework, shielded by state protection and closed to foreign investment. The Ethiopian Airline Group (EAG), a state-owned entity, not only manages the national carrier but also oversees the Ethiopia Airports Enterprise (EAE), responsible for operating more than 20 airports nationwide. Additionally, EAG holds a monopoly on various aviation services, including cargo, maintenance, repair, and overhaul (MRO), aviation training, ground handling, and catering services within the country.

While local investors have access to the sector, their influence is limited due to the dominance of the state-owned and state-run aviation entity, Ethiopian Airline Group (EAG). As EAG controls all aspects of aviation services in the country, including operations, maintenance, and ancillary services, local investors face formidable challenges in competing effectively within the market.

To address this, the federal government is considering lifting the protective veil surrounding the domestic aviation sector as part of its economic reform agenda. Under the banner of the Homegrown Economic Reform (HGER 2.0), a precursor to the upcoming HGER 3.0, initiatives are in motion to liberalize the market. If implemented, this progressive measure will inaugurate an era of openness, inviting foreign investors to participate in the local aviation industry under the 49/51 equity ratio.

Current market statistics.

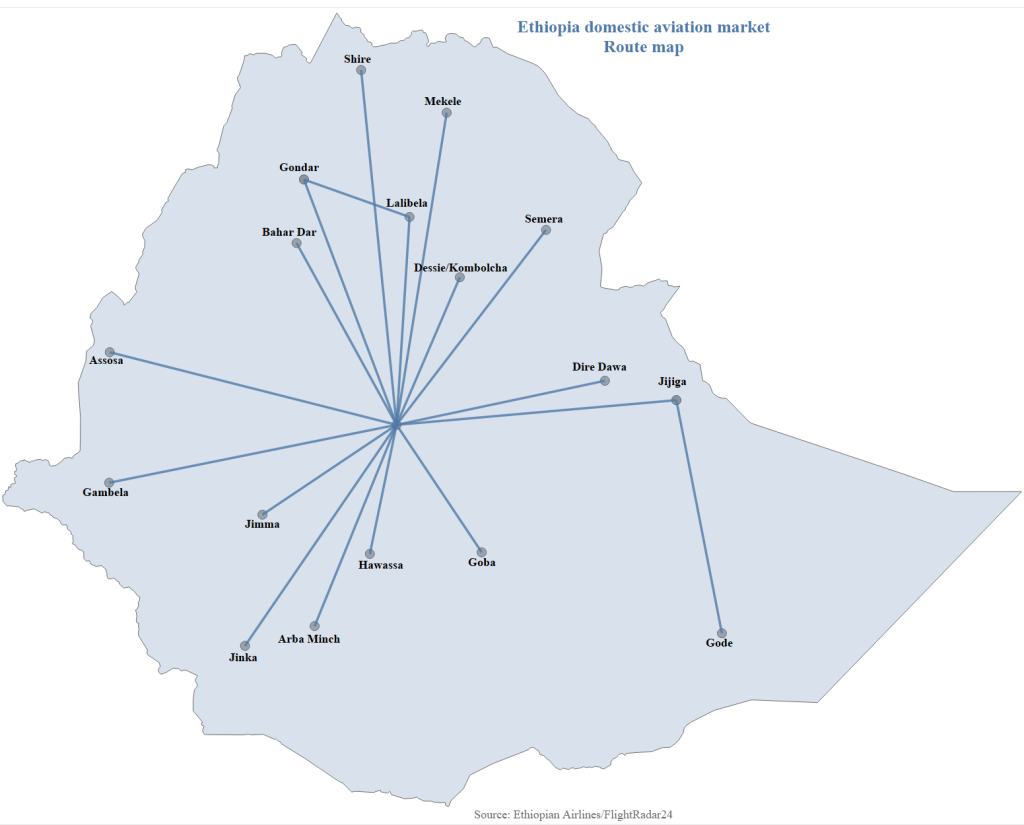

At its prime, Ethiopian Airlines served 22 domestic destinations, but now it navigates the skies to 17 local hubs (see Fig 1), relying on the Bombardier Dash8-Q400 as its trusty domestic workhorse. This aircraft, with its 78-passenger capacity, forms the backbone of the airline’s domestic fleet, ensuring seamless connectivity across Ethiopia’s diverse landscapes.

All flights to these destination airports commence and conclude in Addis Ababa, with two exceptions. Ethiopian Airlines operates a daily triangular schedule between Addis Ababa, the cities of Gondar and Lalibela, as well as a daily flight originating from Addis Ababa to Jijiga, then onward to Gode before returning along the same route to Addis.

Fig 1: Route Map

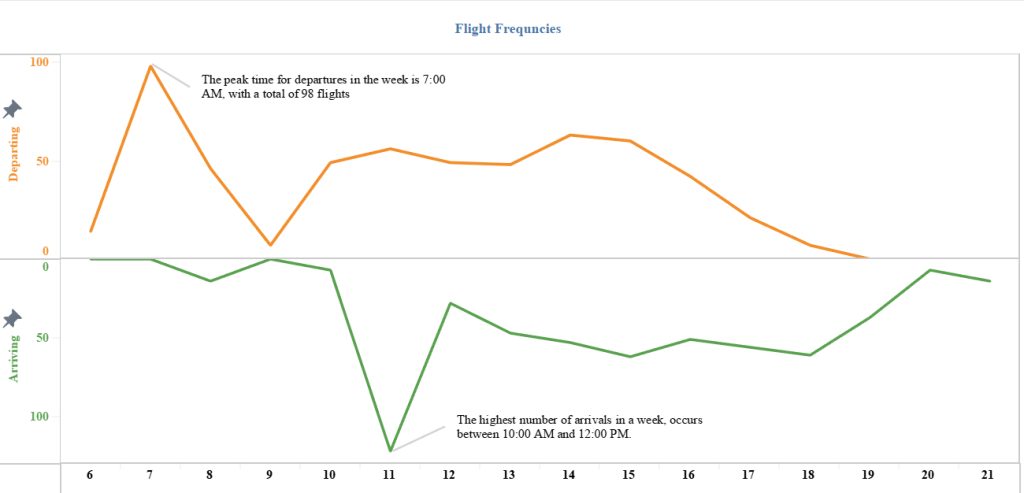

When examining the daily flight frequencies, it’s notable that most flights depart between 0600hrs and 0900hrs, with 0700hrs being the peak hour. The final departure of the day typically occurs at 1900hrs. Conversely, most arrivals take place around 1100hrs, with the last local flight touching down at 2100hrs in the evening (see Fig 2).

Fig 2: Weekly flight frequency

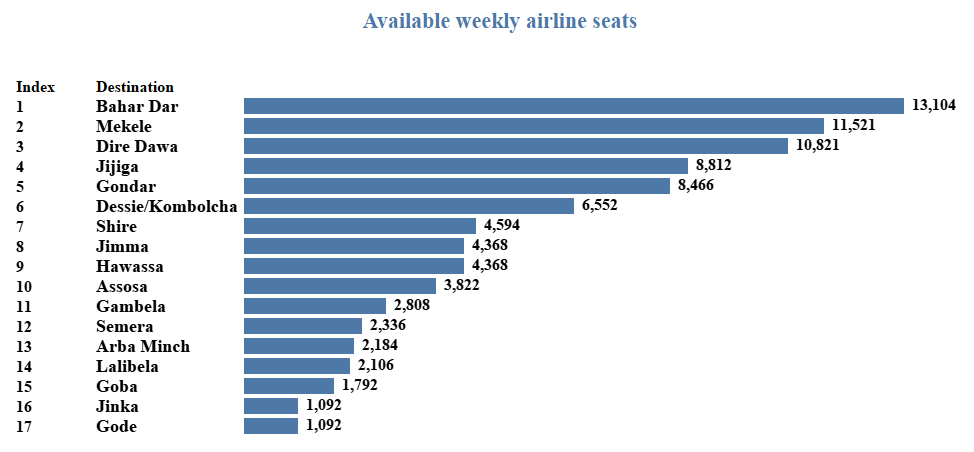

The domestic market boasts an average of approximately 12,834 daily airline seats, totaling around 89,838 weekly domestic airline seats. This translates to an estimated 4.5 million annual domestic seats. Notably, Bahar Dar leads the pack with a weekly airline seat capacity of over 13,000, followed closely by Mekele (11,500), with Dire Dawa coming in third with about 10,800 (see Fig 3).

Fig 3: Airline seats

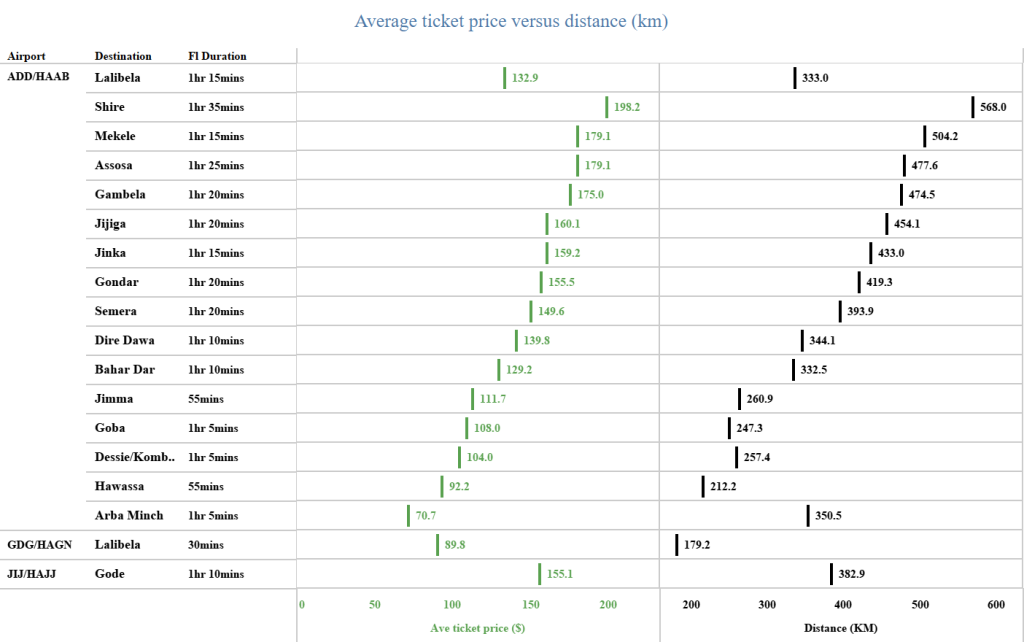

The longest domestic route spans to the city of Shire, covering a distance of 568 kilometers based on great circle distances (GCD) calculations (though the actual distance may vary). Conversely, the shortest route is from Gondar to Lalibela, with a distance of 179.2 kilometers.

The average ticket price for a domestic flight stands at US $143. Interestingly, while pricing typically correlates with distance, the Addis to Arba Minch route boasts the cheapest airfare among destinations of comparable distance. Despite its relatively small weekly capacity of about 2,100 seats, travelers enjoy more affordable fares on this route compared to others.

Fig 4: Ticket price versus distance versus flight time

When we calculate the weekly available seat kilometers (ASKs) by multiplying the total available domestic airline seats by the distance traveled, we arrive at an approximate figure of 34,525,973 ASK. However, determining the revenue passenger kilometers (RPKs) is challenging due to undisclosed load factors, as they are not published anywhere.