PART II

Intracontinental point-to-point air connectivity

This is the second part of a two-part series, where we explore the Intra-African airspace market, the movers and the shakers.

Introduction

The role of air transportation is to establish connections across international borders, facilitating the movement of goods and individuals from various backgrounds for purposes such as trade, tourism, and other endeavors, all while significantly reducing travel time.

On January 1, 1914, a significant milestone marked the beginning of a new era in commercial passenger air travel. It was on this date that the first scheduled domestic passenger airline service took flight, utilizing a flying boat to traverse Tampa Bay in Florida, USA, completing the journey in approximately 23 minutes. Among the passengers on this groundbreaking flight was Abram C. Pheil, a former mayor of St. Petersburg, Florida, who became the very first commercial airline passenger. Around six years later, on August 25, 1919, the British company Air Transport and Travel Ltd (AT&T) accomplished another extraordinary feat by operating the world’s first international passenger flight. Originating in London and bound for La Bourget, Paris, this momentous journey carried a sole passenger, George Stevenson-Reece, a renowned journalist who became the world’s first documented international air traveler. These remarkable events captured the public’s fascination, leading to the widespread adoption of such services, and subsequently inspiring competitors to enter the industry.

In Africa, the advent of commercial passenger air transportation took place in the early twentieth century, specifically during the late 1920s. The carriers operating during this time were primarily European operators, including Air France, Imperial Airways, and Deutsche Lufthansa. However, it is worth noting that the first controlled heavier-than-air powered flight in Africa occurred on December 28, 1909, in South Africa, courtesy of a man named Albert Kimberling. On March 19, 1910, Kimberling achieved another milestone by flying the first fare-paying passenger in Africa, a gentleman named Thomas Thornton, who paid 100 euros for the charter flight. While there is some debate over whether Abram C. Pheil or Thomas Thornton were the first paying passengers of an airline, their actions undeniably marked the dawn of the commercial passenger air transportation era.

Identifying the initial airlines in Africa presents a challenging task due to the intricate history of the industry. Much like their global counterparts, many African airlines established in the early twentieth century underwent significant transformations, including mergers, name changes, acquisitions, and even bankruptcy, which often obscured their original identities. Nevertheless, the first officially documented commercial air service within Africa can be attributed to Union Airways Company (Pty) of South Africa. This airline made its inaugural flight on August 26, 1929, between Maitland and Port Elizabeth, carrying five bags of mail. The airline primarily operated regular routes connecting the cities of Johannesburg, Durban, and Cape Town in South Africa, with a particular emphasis on facilitating connections with mail boats.

Approximately six years later, in February 1934, Union Airways underwent a significant transformation. After being nationalized and taken over by the South African government, the airline was renamed South Africa Airways. Consequently, South Africa Airways introduced commercial passenger services connecting the cities of Durban and Johannesburg. This development effectively stripped Union Airways of its distinction as the first commercial airline in Africa.

While South Africa Airways may be recognized as the first airline established in Africa, Egyptair holds the distinction of being the continent’s inaugural air carrier. Originally known as Misr Airlines, it was founded on June 7th, 1932, and commenced operations approximately a year later in 1933. However, the history of this airline is intricate, marked by numerous name changes, reorganizations, and changes in ownership, leading to its current designation.

Additionally, it is worth acknowledging the presence of other airlines on the continent that can trace their origins back to colonial air services and small private companies that emerged in the 1920s. One such example is the now-defunct Rhodesian Aviation Syndicate, established in 1927 in Bulawayo, Rhodesia (now Zimbabwe). This airline holds the distinction of being regarded as the first air charter in Africa.

But how has the intra-African air transport connectivity panned out about a century later?

This analysis aims to situate African air transport intra-connectivity within the broader framework of global aviation and explores the geographical aspects of air transport on the continent. The focus lies on examining existing route networks and the pair-wise airline connectivity between African countries. Additionally, this analysis acknowledges the significance of major African carriers and offers insights into the interrelations among Regional Economic Communities (RECs) and regional blocs. The data utilized in this study is sourced from airlines and airports’ online platforms.

Intra-Africa air connectivity: Countries connectedness

Based on data pertaining to African airports and airline schedules, it can be observed that all fifty-four (54) sovereign African countries maintain direct air connectivity with at least one other African nation. However, the extent of point-to-point air connectivity varies considerably across different regions. The distribution of these connections offers valuable insights into the overall intracontinental air travel within the continent.

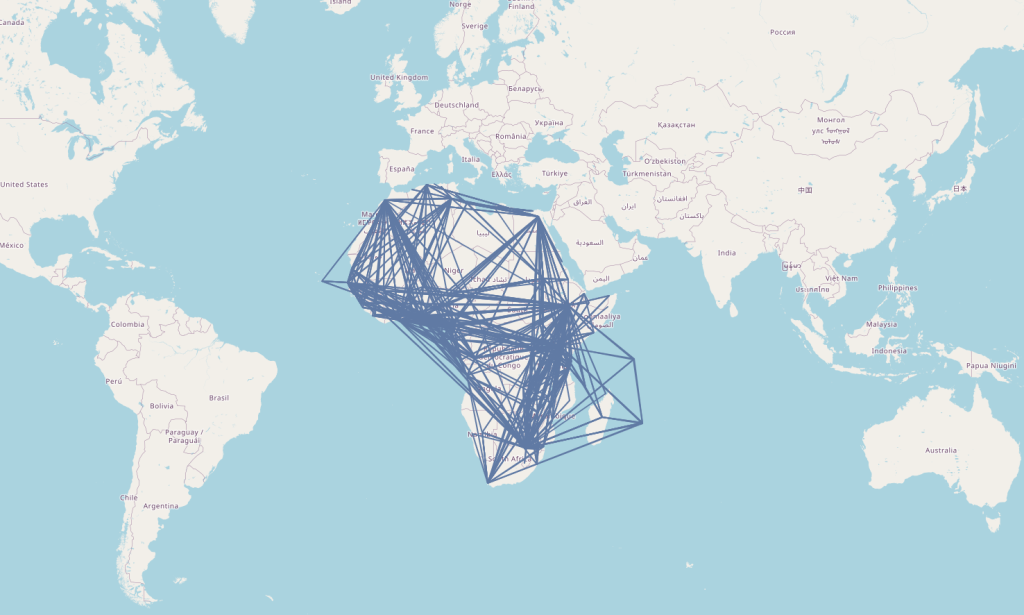

Map 1. Intra-Africa airline destination heatwave

In our prior analysis of intercontinental direct scheduled airline services, the North African region emerged as being more extensively connected on an intercontinental scale (beyond Africa) as opposed to within the continent itself. Within the scope of this analysis, it is noteworthy that the Northern African region continues to exhibit fewer airline connections with countries located south of the Sahara Desert. Conversely, the eastern African region is characterized by a robust and highly competitive scheduled airline route network. Nonetheless, it is important to highlight that South Africa remains a prominent and favored destination within the continent.

Among the various regions in Africa, namely Central, Eastern, Northern, Southern, and Western Africa, there are notable disparities in terms of intra-airline connectivity (See Map 2). To illustrate, the Eastern African region exhibits a higher number of airline connections with the Western African region. On the other hand, the Northern Africa region demonstrates limited airline connectivity with other regions, with Morocco and Egypt being the only exceptions. Notably, the Central Africa region displays the lowest level of intra-Africa airline route network, primarily due to the absence of a major airline hub in comparison to the other regions.

Map 2. Intra-Africa airline connectivity

Upon examining individual African countries in terms of direct intra-Africa air connectivity, it becomes evident that Ethiopia boasts the highest level of connectivity. Ethiopia maintains direct air links with 39 African countries, as depicted in Figure 1. This outcome is expected, given that Ethiopia serves as the headquarters for the African Union (AU), and its national carrier stands as the largest hub air carrier on the continent. Another noteworthy country with airline connections to over thirty (30) countries is Kenya, which has direct connections to 31 African countries.

Figure 1. Intra-African countries airline connectivity

Côte d’Ivoire, a Western African nation, occupies the third position in terms of direct air connectivity with other African countries, maintaining direct links with 25 countries. This unequivocally establishes Côte d’Ivoire as the most connected country in West Africa. Following closely at the fourth position is Morocco, which boasts direct airline connections with 24 African countries. South Africa and Togo share the fifth position, each having direct airline links with 23 African countries. Nigeria, the most populous country on the continent, occupies the seventh position with direct air connectivity to 21 countries.

Conversely, the countries with the least intra-Africa connectivity are the Republics of Eswatini and Lesotho. These two nations have a singular airline connection solely to and from South Africa. However, considering their geographical and population sizes, as well as their legal association with South Africa, a significant aviation player on the continent, these two countries can be considered exceptions. In addition to Eswatini and Lesotho, there are a few other countries with limited scheduled air connectivity within Africa. Namibia, for instance, has connections to only two countries, namely Ethiopia and South Africa. Djibouti, Eritrea, and The Gambia also fall into the category of the least connected countries, as each of these nations maintains direct scheduled airline links with only three other countries within the African continent.

When examining the data from the perspective of the number of airports operating or receiving intra-Africa air connectivity in each country, the Democratic Republic of Congo (DRC), Nigeria, Mozambique, and somewhat surprisingly Somalia emerge as leaders, with four airports each (refer to Figure 2). In Somalia, the cities of Bosaso, Hargeisa, Kismayo, and Mogadishu all have scheduled airline services to Nairobi, Kenya. Additionally, countries with a minimum of three airports hosting scheduled intra-Africa airline operations include Algeria, South Africa, Tunisia, Tanzania, Zimbabwe, and Zambia.

Figure 2. Countries per number of airports with schedule intra-Africa airlines operations

In terms of the distribution of direct intracontinental routes on a country-by-country basis, South Africa unquestionably claims the forefront (refer to Figure 3). This nation boasts a remarkable eighty-two (82) scheduled airline routes connecting various African countries. Following closely behind is Ethiopia, with 67 Origin-Destination (O-D) airline routes, securing the second position. Kenya secures the third position with 61 routes, while Tanzania trails behind at a considerable distance with 38 routes. Egypt concludes the top five with 33 point-to-point airline routes.

Figure 3. Country schedule point-to-point air pairs per routes

Intra-Africa air connectivity: Airlines

When it comes to airlines providing scheduled commercial passenger services, it is worth noting that there is a higher representation of African-based airlines offering operations to or from the Republic of South Africa. The total number of airlines with direct operations to or from South Africa amounts to 27 (refer to Figure 4). This aligns closely with the aforementioned finding that South Africa holds a leading position in terms of the number of airline routes within the African continent.

Nigeria secures the second position in terms of the number of airlines offering scheduled services, with 18 carriers operating in this market. Kenya and Tanzania are tied for the third position, with 16 airlines each providing scheduled operations. The Democratic Republic of Congo follows in fourth place with 15 airlines, while Cameroon concludes the top five with 14 airlines serving its main airports. On the contrary, approximately 10 airlines operate scheduled intra-Africa flights to or from Bole International Airport in Addis Ababa, Ethiopia. It is important to note that Ethiopian Airlines predominantly operates the intra-continental airline routes leading to Ethiopia, thereby limiting the number of airlines serving this particular market.

Figure 4. African countries per distribution of air carriers with scheduled services

However, it is important to note that these statistics are based on the interconnectivity between individual African countries in terms of point-to-point airline scheduled operations, also known as Origin-Destination (O-D) pairs. These statistics do not take into account the number of flight frequencies operated by the airlines.

So, which are the leading airlines in the continent with respect to point-to-point air connectivity?

As of April 2023, there are a total of 77 airlines offering scheduled intra-Africa air services. In this context, intra-Africa air services refer to those airlines that operate scheduled flights in a country other than their home (hub) country. Among these airlines, approximately 79.2% (or 61 airlines) are members of the International Air Transport Association (IATA), while 38 airlines (or 49.4%) are affiliated with the Africa Airline Association (AFRAA). However, it is worth noting that there are other AFRAA member airlines whose scheduled operations are limited to domestic flights.

Upon examining the origin of the airlines domiciled in Africa, it becomes evident that a majority of these airlines have their hubs located in the Eastern African region. This bloc comprises 25 airlines that offer services to at least one other country on the continent other than its home (hub) country (refer to Figure 5). Moreover, within the Eastern African region, there are three prominent airline hubs: Addis Ababa in Ethiopia, Nairobi in Kenya, and Kigali in Rwanda. Following closely behind is the southern African bloc, with 18 airlines operating in the region. The city of Johannesburg in South Africa serves as the main regional hub for this region. In the Northern African region, there are 14 airlines with major airline hubs situated in Casablanca, Morocco, and Cairo, Egypt. The Central African region is home to 10 registered airlines providing intra-Africa operations, with a mini-hub located in Malabo, Equatorial Guinea. Lastly, the Western African region also accommodates 10 registered airlines offering scheduled intra-Africa operations. The major airline hubs in this region can be found in the cities of Lomé in Togo, Abidjan in Côte d’Ivoire, and Dakar in Senegal.

Figure 5. African airlines distribution per region

Among the 77 identified airlines operating scheduled flights within Africa, Ethiopian Airlines emerges as the unequivocal champion of African airspace. When considering country-to-country pairings, Ethiopian Airlines connects from its hub at Bole International Airport in Addis Ababa to an impressive 38 countries across the continent. Following closely behind is Kenya Airways, which operates scheduled services from its hub at Nairobi-Jomo Kenyatta International Airport to 30 African countries. In the third position, we find the Moroccan flag carrier, Royal Air Maroc, with direct services from its hub at Mohammed V International Airport in Casablanca to 25 African countries. ASKY Airlines, a private carrier headquartered in Lomé, Togo, secures the fourth position with intra-African connections to 20 countries, primarily within the Central and Western African regions. Rounding up the top five is Air Côte d’Ivoire, offering scheduled air links to 19 countries.

Other notable airlines providing intra-African services include EgyptAir, which connects from its hub in Cairo to 18 countries, and RwandAir, based at Kigali International Airport in Rwanda, also serving 18 countries. Airlink, operating out of South Africa, TAAG Angolan, and Tunisair, the national carrier of Tunisia, complete the list of top African airlines based on country-to-country pairings, with operations in 13 countries. However, it is important to note that this analysis does not take into account the specific designations or destinations these airlines serve. For instance, Airlink has multiple destinations across various countries, resulting in a significantly larger Airlink route network.

When considering the number of scheduled airline route networks, Ethiopian Airlines continues to lead the pack. It stands as the sole carrier with over one hundred point-to-point air routes within the continent, boasting a total of 113 routes (refer to Figure 6). Kenya Airways follows closely behind with a total of 78 routes, while Airlink, based in South Africa, secures the third position with 55 routes, despite serving only 13 countries. Royal Air Maroc is the other airline with a route network surpassing fifty, precisely offering 51 scheduled routes.

Figure 6. Top airlines per number of schedule Intra-Africa route network

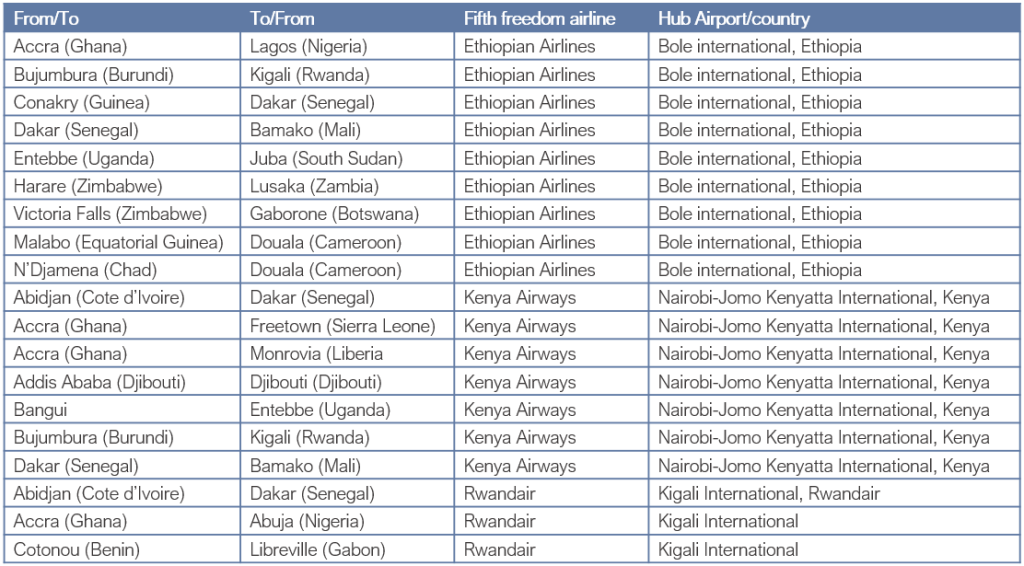

However, it is important to note that the aforementioned routes are calculated based on the third and fourth freedom rights granted to the airlines. These routes represent the Origin-Destination (O-D) pairs for the airlines. If we consider the fifth freedom rights granted to these airlines, some of their route networks could be significantly larger. Both Ethiopian Airlines and Kenya Airways, for instance, have established multiple fifth freedom rights agreements with various countries in Africa (see Table 1).

Fifth freedom rights allow an airline to operate flights without the requirement for the flights to originate or terminate at its home (hub) airport. It grants the airline the privilege of carrying passengers from its home country to a second country, and from that second country to a third country, and so on. This freedom opens up additional opportunities for airlines to expand their route networks. In Africa, there are several notable fifth freedom rights agreements in place.

Table 1. Sample fifth freedom rights agreements in Africa

Conclusion

When it comes to intra-continental scheduled airline services, Europe stands out as the leader among other continents. This is primarily attributed to the positive impact of airspace liberalization achieved through the implementation of the single European act by the European Union (EU). This act successfully eliminated barriers to competition within the EU airspace, granting airlines the freedom to operate unrestricted across European countries. The EU’s approach serves as an excellent benchmark for the realization of similar liberalization efforts in the African airspace.

The deregulation of African airspace is expected to have significant benefits, not only in terms of enhanced airline connectivity but also in accelerating the growth of intra-Africa trade. The launch of “Agenda 2063: The Africa We Want” represents a promising step in the right direction. The African Union (AU), through Agenda 2063, envisions a unified African continent with seamless borders and effective management of cross-border resources through dialogue. The ultimate goal is to create a continent where the free movement of people, capital, goods, and services fosters substantial increases in trade and investment. By working towards these objectives, Africa aims to unlock its full potential and foster greater integration and development across the continent.

Therefore, the successful implementation of key flagship projects of the African Union (AU) such as the Single African Air Transport Market (SAATM), the Africa Continental Free Trade Area (AfCFTA), and the African Passport and Free Movement of People is crucial in bolstering Africa’s trading position and realizing the objectives set forth in Agenda 2063.

Analyzing the current data and observing the concentration of airline route networks (refer to Map 2), it becomes apparent that airline deregulation in Africa needs to be approached strategically. The networks exhibit a geographical concentration, with no single airline offering scheduled services to all five regions of the continent (Central, Eastern, Northern, Southern, and Western Africa). Ethiopian Airlines, Rwandair, and Kenya Airways are the exceptions, as they have scheduled operations in all regions except for Northern Africa.

Given this observation, and assuming interline agreements and code shares remain unchanged, it can be inferred that the rapid implementation of Agenda 2063’s flagship projects, such as the African Continental Free Trade Area and the Single Africa Air Transport Market, primarily rests on the Regional Economic Communities (RECs). It is crucial for the RECs to relax restrictions on the movement of people and passport controls, as well as eliminate governmental protectionist practices that hinder air carriers expansion.